Why Investment Property Edinburgh – Edinburgh is the best place to invest in residential property in the UK; an educated city with 4 Universities and a growing population (500,000, expected to rise to 600,000 by 2035). The city offers an amazing quality of life and it’s a huge tourist destination. Edinburgh’s economy is driven by the strong financial services sector (RBS, Lloyds, Baillie Gifford, Standard Life, Scottish Widows, Aberdeen Asset Management, Tesco Bank, Virgin Money) and there is a rapidly emerging technology sector (Skyscanner, FanDual, Cirrus Logic) with many other businesses on their way to Unicorn-stardom.

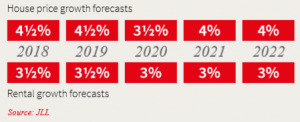

Property value and rent forecasts – JLL Property Consultants have made some positive predictions on where the Edinburgh property market will go over the next 5 years to put some data behind the general good-feeling in the city:

How much to invest – we have a lot of success buying 1-bedroom professional let-type properties in locations close to the city centre. These properties will range from £110,000 to £170,000 and we aim to deliver a gross yield of 5.5%+ (normally achieving 6%+).

1 Bedroom professional lets – This type of property works very well for investors. Properties within walking distance of the city centre are popular with professionals and affordable for those tenants, particularly if the rent is split between a professional couple sharing. While larger student properties tend to let in cycles over the summer months, 1-bedroom professional lets are popular year-round. According to the most recent Citylets Rental Market Report, rents for 1 bedroom properties grew by 6.3% year on year to Q2 2018 (33.9% growth in 5 years) with a Time To Let of only 23 days. The number of professionals choosing to relocate to Edinburgh, or to remain in Edinburgh post-University, continues to grow. Many of these young professionals struggle to get onto the property ladder leading to more people renting. You can understand why the market looks set to continue to grow into the foreseeable future.

Investment Property Edinburgh Where to invest – There are 3 key areas we tend to target;

- Leith Walk and surrounding areas – The Leith Walk areas is one of the highest growth districts in Edinburgh. There’s loads of development happening, anchored at the top of Leith Walk itself by the new Edinburgh St James development, due to complete in 2020 which will surely impact positively on property and rental values in the vicinity. Edinburgh University are relocating a lot of their student accommodation to this part of town and it nicely links up the city centre with the large-scale redevelopments around Leith and The Shore, including Edinburgh Skyliner and The Ropeworks.

- Fountainbridge, Polwarth & Tollcross – This part of town has seen a huge amount of regeneration over the past 10-15 years and there’s more to come with several gap sites ear-marked for residential development over the coming 5 years including Vastint’s development and Moda Living’s large scheme. This will undoubtedly pull property capital and rental values upwards so now is a good time to buy. Edinburgh’s core office area around Morrison Street/Lothian Road/The Exchange is a short walk away so this is popular with professionals working in the offices nearby.

- Dalry, Haymarket & Gorgie– Another fantastic option around the West of the City Centre is the EH11 corridor running West from Haymarket station. This area is within walking distance from Edinburgh’s main office district and the City Centre and is well placed for bus routes out to West Edinburgh and to Heriot Watt and Napier Universities. The imminent development of the gap site opposite Haymarket Station will certainly cause a ripple effect in property values and rents throughout this area so now is a great time to get in on the action.

- Find out more about the Edinburgh buy to let market. Sign up for investment property Edinburgh opportunities.