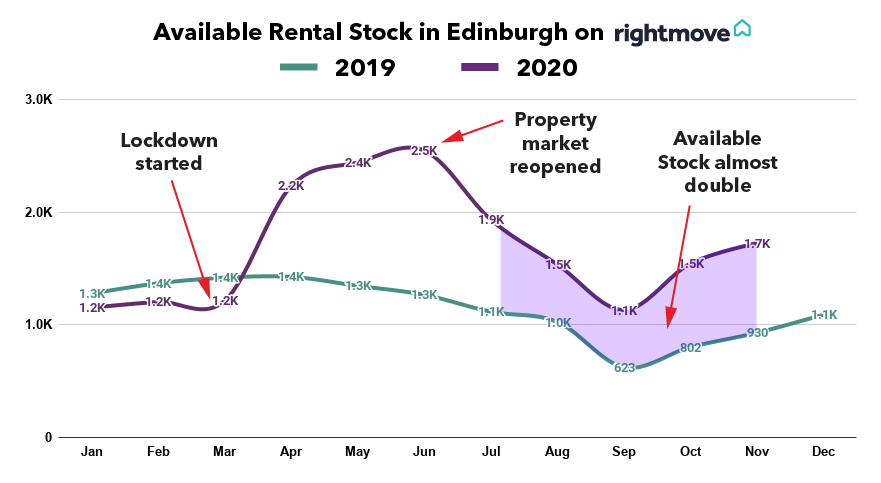

A picture tells a thousand words and we’ve created a chart which nicely tells the story of a turbulent year for the Edinburgh rental market.

The chart shows the key events of lockdown starting in March and then the property market “reopening” in June and the significant effects on the available rental stock levels as a result. The 3rd thing illustrated in this chart is the lasting effect on the available stock levels that have remained 1.5 to 2 times higher in 2020 than the same dates in 2019.

January to March

Prior to lockdown, 2020 was recording less available rental stock on the market than in 2019. The rental market overall was growing but tenancies were lasting longer and available properties were spending less time on the market. The effect of this was around 15% less rental property on the market during the first 3 months of the year. Tenant demand was high, available stock levels were low and rents were rising as a result

April to June

Along came COVID and within a few short weeks, the rental market trend for 2020 changed completely. Hundreds of properties were vacated at short notice and the level of available rental properties more than doubled during April to June. Normally available stock levels would gradually reduce over this period as we can see from the 2019 data, but not this year

July to September

With non-essential housing moves being allowed again and the reopening of Edinburgh’s universities, 2020 available stock levels started to drop quickly as a huge number of new tenancies were agreed. Despite the volume of available rental properties reducing by more than half in July to September, the levels for 2020 still remained at least 1.5 times the levels of 2019. During this short time over the summer, at Umega we started to see the number of tenant notices served increasing from August, and peaking in September. A large number of these were student tenancies where students had reserved a property to let but decided to make a U-turn, moving back to their family home to continue their studies remotely, in response to the continued COVID Pandemic.

October to December

As we enter the winter, the number of available rental properties is on the rise again. This is to be expected in a normal year as we can see from the 2019 data, but this trend is significantly exaggerated this year due to the high volume of available stock still on the market at the end of the autumn and the high amount of notices served from August to October. We expect this trend to continue until the end of the year, meaning the Edinburgh rental market will finish 2020 with a record volume of available rental properties which is good news for prospective tenants. From a landlord’s perspective, while these numbers may look worrying, properties are still letting, just at a slightly slower rate. The average time a Umega property spends on the rental market is up to 27 days, 3 days higher than the same time last year, so the market is turning over and properties are still letting, it’s just taking a little longer.

What does 2021 have in store?

Our view is that it’s likely properties will take longer to let over the next few months and rents will be slightly reduced as a result but the impact on individual tenancies will not be as dramatic as the available stock data might suggest. The reason for this could be that, despite the impacts of COVID on the rental market this year, there continues to be a higher demand from prospective tenants than the supply of quality rental property.

We expect available stock levels to remain much higher than in 2019 until the spring time when the available rental stock in Edinburgh will drop closer to pre-COVID levels. We’ll keep a close eye on what’s happening, learn as much as we can and share what’s helpful.