Higher rate tax payers – mortgage interest relief

To try to simplify how mortgage interest is treated when calculating your self-assessment for residential property, we pulled in the mind of Stuart Clark from Russell & Russell who has a knack for explaining these things in plain-English. We hope this helps!

The basics

When calculating self-assessment income for residential property only the mortgage interest (and NOT the capital element of your monthly payment) is an allowable expense;

- Rental income: £1,000 / month

- Mortgage payments: £750 / month (let’s assume that this is made up of £300 capital and £450 interest)

- Net cashflow profit: £250.

- However, the taxable profit is £550 (£1,000 – £450 interest)

Changes to the system

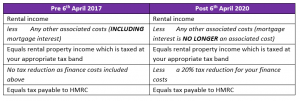

In addition to this HMRC have put in place further restrictions for the tax relief on finance costs since 6th April 2017. These are underway and are being phased in with them fully in place by 6th April 2020. Simplistically, if you are a higher rate tax payer with a rental property you would previously have received tax relief at 40% on your mortgage interest, but this will be restricted to 20% from 6th April 2020.

How it works in practice

The tax reduction isn’t simply your finance costs, it is the lower of;

- Your finance costs (plus any finance costs brought forward),

- Property business profits or

- Adjusted total income (income after losses and reliefs, including personal allowance, and excluding savings and dividends income).

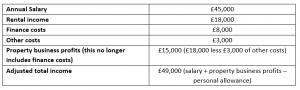

An example of Tax Reduction Rules:

Let’s review the 3 items available for tax reduction in this example:

- Your finance costs – £8,000

- Property business profits – £15,000

- Adjusted total income – £49,000

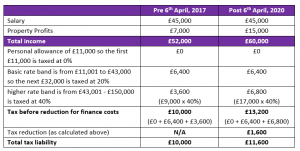

The lower of the 3 is therefore the finance costs of £8,000. 20% of this figure results in a tax reduction of £1,600. Previously this landlord would have received tax relief at 40% (£3,200 deduction) as they were a higher rate tax payer. A higher rate tax payer would therefore pay an additional £1,600 in the example above which can be seen from the detailed analysis of the tax liability below:

In order to compare the impact of the changes the same tax rates have been used in all the examples (2016/17 rates – i.e. pre 6th April 2017). The tax rates will differ each year and the Scottish Rate of Income Tax bands will also need to be taken into consideration if you are a Scottish resident.

Some more detailed examples are available via this link.

Russell & Russell are a firm of proactive accountants who utilise the latest technology to assist their clients to take home more of what they earn and to understand their numbers. If you would like to find out more about their services, contact Stuart Clark on 0141 332 6331 [email protected]