Citylets has recently published their quarterly market update to tell us all what’s been going on in the Scottish rental market over the last quarter. You can take a look at Citylets report here (our very own Neil gets a wee name check, quote and photo on page 12). We’ve summarised a few key highlights focusing on Edinburgh’s rental market in case you don’t have time to look at the full report.

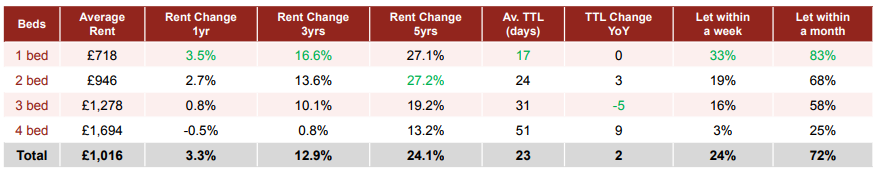

As is often the case towards the end of the year, the rental market cools as we enter the traditionally quiet December period when tenants have their mind on things other than moving to a new house (cue a mad rush every January after those life-changing decisions made over the festive period!). Year on year growth to Q4 2017 was a steady 3.3% from 2016 up 12.9% in the last 3 years.

1 bedroom properties lead the way – The 1 bedroom market continues to perform best with annual rental growth of 3.5% and with 33% of properties letting within a week as this size of property attracts professional tenants and couples. 1 bed properties in all the key areas in walking distance of the city centre including Leith Walk, Dalry, Fountainbridge and Canonmills continue to make fantastic investments delivering strong yields.

Larger properties stall but don’t panic – As we would expect at this time of year, rents for 4 bedroom properties stall at this time of year but these are bound to pick up dramatically between now and Spring when most of the student properties for the next academic year are advertised, no doubt achieving record rents. It seems like yesterday we were valuing student flats at ‘£350 a room’ while now £500 a room is a safe benchmark with the best properties nudging £600 a room. The growing number of Purpose Built Student Accommodation (PBSA) blocks does not seem to have cooled the demand for traditional student properties around the city.

We expect rental growth levels to increase as we enter the busier summer months with time-to-let falling for all properties as the temperature warms up around Edinburgh.

Looking at the impressive rent growth of 24.1% over 5 years this reiterates what a solid investment option property is. Combine this with capital growth of 8.2% in the past year and you can understand why there continues to be a surge of Buy to Let landlords entering the Edinburgh market.