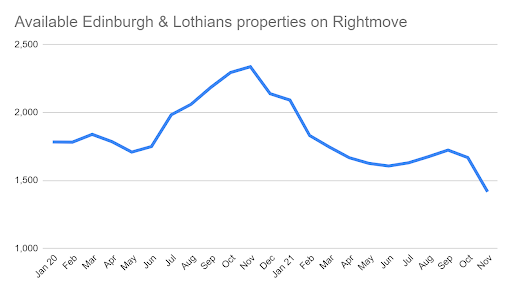

Available stock levels are at their lowest for 2 years.

According to Rightmove data, available stock levels in Edinburgh and the Lothians are almost 40% lower than their peak in November 2020, falling to their lowest level for 2 years last month. Available stock levels have been consistently eroded by strong buyer demand over the past year which has not been matched by a sufficient supply of new homes being added to the market.

Average Edinburgh house prices grew 3.1% in the last year

Looking at the housing market from a UK point of view, Zoopla reported 7.1% annual house price growth across the UK. In Scotland the growth has been a little more modest at 5.3% and for Edinburgh lower still at 3.1%. Zoopla predicts Scotland’s house price growth to be 2.5% in 2022.

While Zoopla’s figures are useful on a national and city-wide basis it’s helpful to look at ESPC to see how more local areas have performed over the past year. According to ESPC, 3 bedroom houses in Currie, Balerno and Juniper Green saw a 30% increase in average selling price over the year to November 2021. The rhetoric has been that family homes with outdoor space have seen the most demand and growth with city centre flats being less popular since the pandemic. The signs are that the market has returned for these types of homes. Looking more closely at homes more typically let out, one bedroom flats around Leith Walk saw selling prices increase by 6.6% while 2 bedroom flats in Leith rose 8.5%. Two bedroom homes in New Town and West End increased 8.2% and 2 bedroom flats in Morningside and Merchiston increased 10.9% in the year.

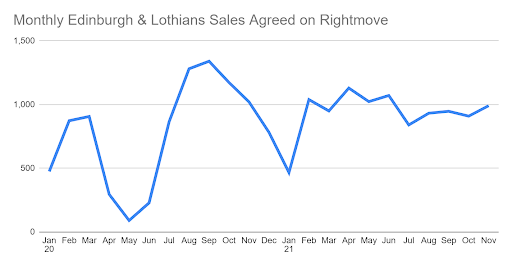

Length of time to agree a sale in Edinburgh well below the national average

According to Zoopla, the average time between listing a property and agreeing a sale across the UK hovered around 50 days before the pandemic. Throughout 2021 it has been consistently below 30 days. The expectation is that the market will start to move at a more normal pace in 2022 presenting an opportunity for the pipeline of homes on the market to build up slightly, although total available stock levels are expected to remain lower than they have historically been. This will contribute towards house prices continuing to rise. Looking at Edinburgh, according to the ESPC homes in Edinburgh took on average 17 days to go under offer, 1 day longer than a year ago and well below the averages Zoopla suggest.

The effect of the recent interest rates rise on the housing market

The Bank of England has increased interest rates from an historical low of 0.1% to 0.25% to tackle rising inflation in the UK. A small change like this is unlikely to have much impact on the housing market. Mortgage rates remain historically low so people can still borrow large sums of money. Further rate rises would have an impact though as homebuyers would find it harder to satisfy lenders affordability checks. However the Bank of England has announced plans to ease mortgage lending rules in an attempt to help first time buyers get on the property ladder. Their proposal is to remove a requirement for borrowers to be able to afford a 3% rise in interest rates before they can be approved for a mortgage; a move expected to help over 85,000 people in the UK secure a mortgage or a bigger loan.