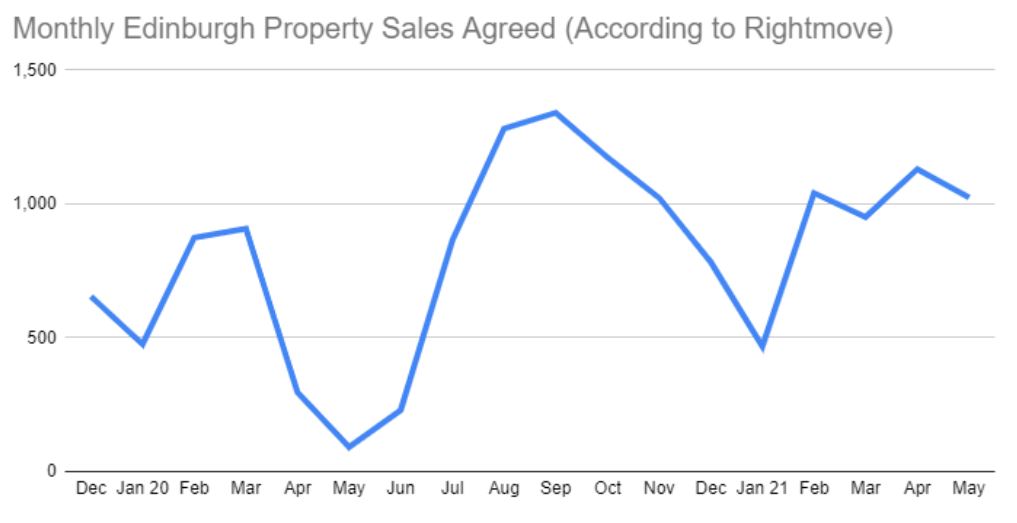

It’s been an unusual 15 months in the residential property market with the enforced shutdown of the property market last spring, followed by a surge of activity last summer.

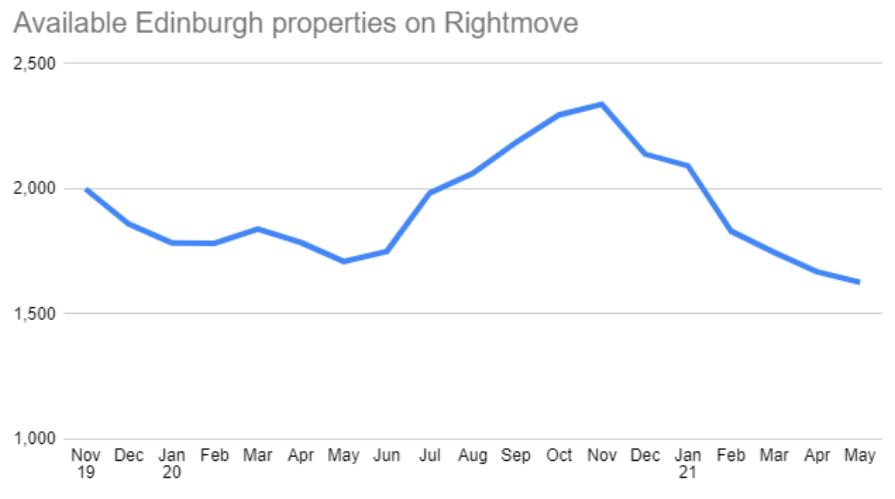

Properties on the market then built up over the winter months, but decent levels of sales since have reduced the volume of properties for sale.

Healthy numbers of new sales this year

After the usual seasonal drop in completed sales around Christmas, figures of new sales agreed bounced back in February, 20% higher than February 2020. Since then, monthly sales agreed have been healthy indicating a strong demand from buyers.

Falling numbers of properties on the market

The strong numbers of sales agreed has impacted the number of properties available on the market as homes have been snapped up by eager buyers looking to make moves. The number of available properties on Rightmove for May 2021 was 5% lower than May 2020. It will be interesting to see if the sunshine and easing of COVID restrictions brings more sellers to the market, however with such strong buyer demand it’s unlikely the available stock on the market will get a chance to grow before buyers come in to snap up any new properties added.

House prices in Scotland growing at their fastest rate in 14 years

The drop in available properties along with continued buyer demand is, unsurprisingly, pushing prices up. Recent reports suggest that house prices in Scotland are growing at their fastest rate in 14 years and forecasts are that this growth is set to continue.

Across Scotland last year, house prices increased by nearly 11% in the year to March 2021, with smaller properties growing by 7.6% and terraced houses rising by 13.3%. Family homes and properties at the middle to higher end of the market have been performing best with many buyers looking for more space in response to time spent at home over the past 15 months.

It’s been more difficult at the first time buyer end of the market (1-2 bedroom flats under £250k) as not only are a lot of buyers seeking more space or access to outdoor space, but also mortgages have been tougher to secure and so deposits required have increased forcing many first time buyers to continue to rent.

The return of lower deposit mortgage products, and an increase in buyer confidence as the vaccination roll out continues, is likely to mean things start to move faster at the lower priced end of the market.