When the conditions created by the Coronavirus pandemic hit the Edinburgh rental market in March, we experienced the impact on our business and across our managed portfolio.

The immediate effect was that a number of tenancies came to an end (with 28 days notice) predominantly for two reasons; tenants from overseas left Scotland before borders were closed for passenger travel and students gave up their tenancies and headed home when university campuses closed for the academic year.

Our advice was clear and consistent with government advice; we would do everything we could to work with landlords and tenants to keep tenancies going through lockdown. Nobody knew exactly how things would pan out and what the impact on jobs and the economy would be, but we knew there would be a need for private rented properties and roofs over heads throughout the pandemic.

Now, nearly six months on, we can look at the data to understand what happened and where the market is headed.

Keeping Tenancies Going

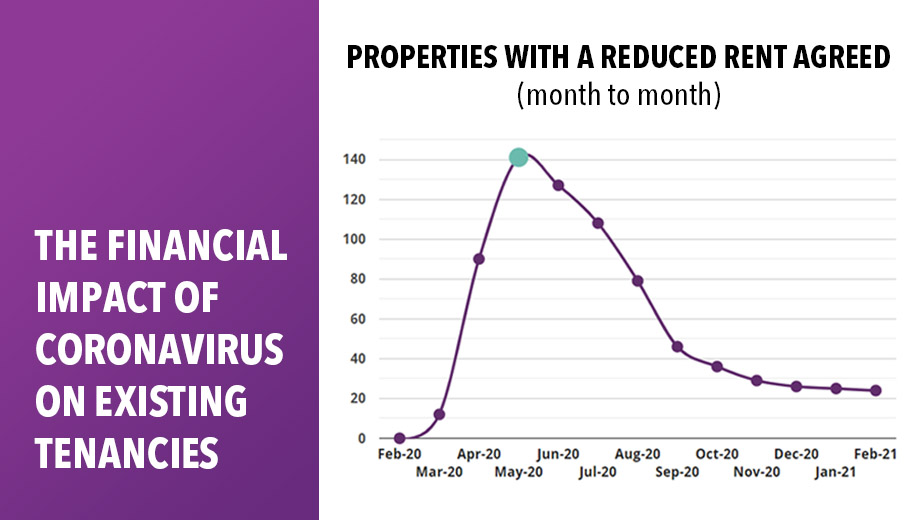

Where tenants had lost jobs or experienced a drop in income but wanted to stay in their homes while they found new employment or until their income increased again, we advised landlords, signposted government support and did everything we could to keep these tenancies going. In many cases, this meant a temporary discount or suspension of the rent owed so that the tenants could recover financially to stay in their tenancy. The number of reduced rents that were agreed peaked in March, dropped significantly in April and the trend since then has been of less reductions or suspensions being agreed.

When we factor in the duration of the rent discount or suspension we can see that May was the month when the highest number of tenancies were running with a rent discount or suspension (over 10% of our managed portfolio at the peak). Since then, most of these tenancies have returned successfully to their full rent level with a small number continuing at a discounted or suspended rate (around 3% as of September 2020).

What about Rent Arrears?

After the initial shock and market turbulence of March, rent arrears across our managed portfolio reduced significantly and have remained relatively low and very static (affecting less than 3% of our managed portfolio).

What does this tell us about how existing tenancies have been financially impacted?

The general picture is positive in that the financial impact on pre-existing tenancies of the COVID pandemic has not been as bad as we had planned for, and expected. The data does not tell the stories behind the tenancies that have been negatively impacted or the emotional support and work for all parties that has been put in to keep so many tenancies going, but the overall picture shows a sector that has not been as badly affected as feared over the last 6 months.

What will happen next?

Obviously we have no way of knowing for certain, but we have reached a stage where the rental sector is back on its feet after a very difficult few months. Things are still moving more slowly as we wrestle our way through working under COVID restrictions and the negative financial impacts of Coronavirus will continue to be felt by many in the market for a long time to come, but as time passes, it is becoming easier to plan a way forward for each tenancy under our care and, if our data is anything to go by, the same will be true across the rest of the sector.